968 Larpenteur Avenue West Saint Paul, Minnesota 55113-6550 (651) 592-0171 mobile matt@uscoles.com

A senior executive I worked with said that people think we just work for a company but really we are all in business together. I like that way of looking at it. When you hire someone, you're not just taking on an employee, you are picking a partner. Do it right and your life gets easier and everyone benefits; do it wrong and it's an aggravating and possibly costly error. You want to know who you're going into business with, and that can be tough to discern just from someone's résumé.

To make things easier, I've taken my résumé and filled in the details. What did the companies do? Why did I leave each position? What brought us to this point? This is useful if you want to get into the specifics to help decide if we should go into business together. After reading through, if you are still interested, we should talk.

I am an experienced financial executive with excellent analytical skills in the financial services and manufacturing industries. I bring curiosity, adaptability and an ability to work with all levels within a firm to provide clarity and insight in financial and operational matters and to understand issues from the smallest details to the broadest picture.

| Financial Reporting | Financial Analysis | Forecasting | Business Intelligence |

| Project Management | Business Operations | Geospatial Analysis | Data Visualization |

| Risk Analysis | Strong software skills | Training & Coaching | Communication |

I started at Travelers to assume the duties related to state surcharges and assessments in the Business Insurance area. States impose assessments on companies and the companies pass these through to policyholders. Not every state does this, but some do multiple assessments, and there are dozens of these totalling tens of millions of dollars a year. My role initially has been to assume these duties from the current people who are slated to retire in the near-term. Additionally, I do work within the BI Actuarial Product on the ROE model, measurements against plans and rate adequacy.

We became COUNTRY employees at the beginning of 2005. There remained a lot of conversion work from taking over MSI. The Central Region required a change in reporting and planning as we took on four COUNTRY states. The reporting formats I developed to understand the Central Region proved useful elsewhere in the company and my monthly results reporting expanded to include the Western Region and later the whole firm. I worked heavily with Underwriting and Claims over time on various projects and worked with Agency periodically, especially early on when there were many questions regarding agent commissions. Some of my projects done at a state or regional level later became Six Sigma Black Belt projects at the home office, where all the Six Sigma projects were handled.

COUNTRY used this photo in employee meetings countrywide showing how Everyday Operational Excellence could work. In this case, the presentation cited one of my projects with these QA folks, Colleen, Kerry and Patty.

COUNTRY used this photo in employee meetings countrywide showing how Everyday Operational Excellence could work. In this case, the presentation cited one of my projects with these QA folks, Colleen, Kerry and Patty.

Late in my time at COUNTRY, I worked with Corporate Actuary in the Illinois home office on the cat bond issuance (working on the subject business section, not the deal structure) and on geo-coding and plotting property risks. COUNTRY, worried about losing their longstanding A.M. Best A+ (Superior) rating, and sensitive to Best's critique of their high expense ratios relative to the industry, decided to divest itself of the Central Region Office building. This had been built as MSI's headquarters in the late 1970s and at one time had over 900 employees; the headcount was down to around 200, parts of the building were rented out, and parts were vacant. COUNTRY laid off a wave of people in 2013. I was one of the few offered the chance to keep my position and move to Bloomington, Illinois, but this wasn't a viable choice for our family, so I chose redundancy. COUNTRY sold the building to nearby Bethel University in December 2013. To be clear, COUNTRY is not withdrawing from Minnesota; it leased back a part of the building for the remaining Agency, Claims and some Commercial Underwriting personnel needed to service the customer base here and the building still has the primary IT systems backup for COUNTRY nationwide.

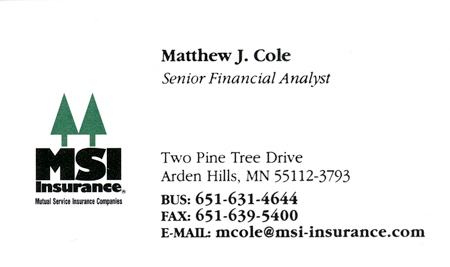

I joined MSI in late December 1996. The company was a fairly sleepy small regional insurance company. It was also the only cooperatively-governed insurance company in the country, a fact of which they seemed inordinately proud, but whose loose and vague governance facilitated what is about to follow. MSI had got in trouble in the 1980s in group health lines and exited that business. The personal lines insurance business, written in four midwestern states and California, was steady but a bit dull, so to grow premium, top management decided to expand rapidly in several markets. These proved to be MSI's downfall, as a bad venture investment in Texas, rapid expansion into large commercial property and agricultural processing risks, poorly conceived fronting programs and the rapid collapse of a major reinsurer all conspired to devastate MSI's equity. By the end of 2001, MSI's unassigned policyholder's surplus, essentially its net worth, wouldn't have bought a cup of coffee: -$5.9 million, down from $80 million at the end of 1999. This footnote, from the 2001 Annual Statement, speaks volumes:

At December 31, 2001 the consolidated group had $107,661,171 of operating loss carry forwards originating in 1997 through 2000 which will expire, if unused, in years 2012 through 2021.

Companies in this condition are at risk of being placed in liquidation by the Insurance Commissioner. Fortunately, the President of MSI had come from Country Companies (as it was then known) and went to them to arrange an investment in surplus notes, which from a statutory point of view are considered equity. This, and a flurry of cash-raising accounting moves, kept MSI alive. COUNTRY's initial investment quickly grew into essentially a takeover of MSI. We became the Central Region of COUNTRY and the surviving staff became COUNTRY employees at the beginning of 2005.

Norwest Document Custody's business was pretty straightforward; keep in a big secure room (the Vault) the original mortgage notes underlying pooled mortgage-backed securities issued by Fannie May, Ginnie May, Freddie Mac and a smattering of private issuers. Send these back to the issuers when they requested them, keep records in the computer, and make sure they matched. Unfortunately, the former manager had done a poor job of this, the computer records were incomplete, the operation was 80% temporary employees and a team was sent from Corporate to oversee straightening out the situation. One solution was more temps, including me and my staff of reconcilers and counters. I ran the reconciliation which included loading in issuer data on hundreds of thousands of loans and physcially inventorying the loans in each pool. There were no instructions on how to do this, I had to invent the process and then, with just a few days head start, start training the incoming temps on their tasks. The project took a year into a headwind of continual staff turnover, a constant training cycle and some persistent technical issues. As the project wound down late in 1996 I recommended to Norwest that they hire me and four or five of the seasoned reconcilers who by this point knew this operation exceptionally well. Norwest was taking their time on this decision. Meanwhile, the supervisor of the counters, Sue, knew of an opening at MSI Insurance, where her husband was a Vice President. With no clarity on the Norwest front, I went to see Al and he hired me; surprised by my departure, and suddenly and appropriately concerned about losing all the temps’ hard-won knowledge, Norwest hired the rest of the people I’d recommended. Sue just retired from Wells Fargo in July 2013; at least one of the others is still there.

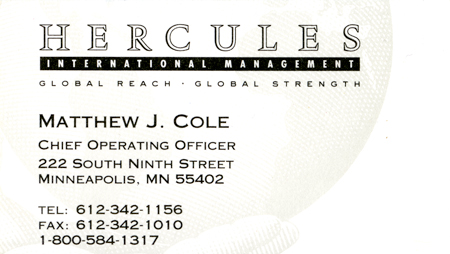

The Hercules Funds were established in an attempt to provide two novel things; a single family of regional global funds and also funds that sold at net asset value, like no-loads, while still paying a commission to the brokers. Mid-sized Piper Jaffray of the U.S. and Midland Walwyn, then the largest independent brokerage in Canada, did this as a joint venture. As an experienced securities-industry person with an accounting background, Canadian citizenship (then: I became a naturalized U.S. citizen in 1999) and also a Legally Immigrated Alien, I seemed well-suited to the Hercules Funds. After interviews in Minneapolis and Toronto, I was hired and we moved north to Saint Paul.

In theory, any brokerage firm in the U.S. could sell the Hercules funds. In practice, it was nearly all Piper brokers who actually sold them here. While there were several reasons Hercules could have struggled in future, the one that mattered was that Piper Jaffray's Piper Capital Management unit, with whom we shared a marketing staff and a floor in the building, got into deep trouble with the billion dollar Institutional Government Income Portfolio, its flagship fund. This fund, run by star money manager Worth Bruntjen, was supposedly nearly money-market-like in safety but suddenly lost around 25% of its value when interest rates moved up in early 1994 due the fund's massive and incompletely understood derivative exposures. This happened literally as I started at Hercules; some of the SEC actions were related to fund mispricing in early April 1994. I had started March 28. (The truly interested can read a detailed account on this SEC Litigation page. Note how they focus on March 31 and the first week in April).

Piper's best brokers had sold the fund to their best clients. They were livid. There was a welter of lawsuits, SEC investigations and executive resignations. The source of much of the toxic waste in the funds, Kidder Peabody, was allowed to go under by parent GE, Bruntjen was banned from the industry for five years (among other things, he'd lied on his résumé), and Piper eventually paid over $138 million in fines, settlements and penalties. The walls that had separated Bruntjen and his staff from us mere mortals on the 20th floor were taken down. From Hercules' point of view, Piper's brokers' anger completely stalled out sales in the U.S., redemptions started coming in as commission clawback anniversary dates passed by, and Piper, who'd hoped 1995 would be a joyful yearlong 100th anniversary celebration, became consumed with dealing with all the fallout of the Institutional fund's issues. Things were going well in Canada, but with the Hercules joint venture partners having divergent paths, my duties shifted from managing the growth of these exciting new funds to helping wind down the joint venture and running the proxy vote to change the U.S. manager to an existing Piper Capital international fund.

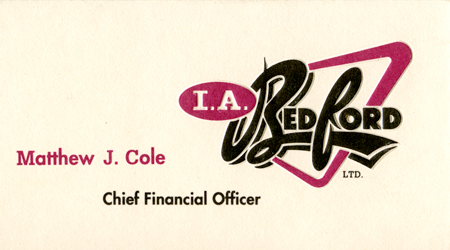

I.A. Bedford was the sales and marketing operation in Des Moines, Taylor-Made Appli-K did the sewing, embroidery and appliqué in Bedford and Clarinda, Iowa. Initially, the company was growing strongly doing licensed apparel primarily to the college bookstore market. I was helping interview CFO candidates when the founder said she'd rather have me than any of the people we'd had apply, and thus I joined the firm. We expanded as quickly as possible, adding several 12-head embroidery machines, the Clarinda location and multiple shifts to meet demand. As time went on, some unfortunate hires in management positions and a shift to the much more fragmented and less-profitable golf markets put additional strains on the company. The sales manager and the founder began living together and the office atmosphere in Des Moines became indescribably bad, so that in an office averaging 16 people, 12 left during the year. I eventually tired of the abusive management style and resigned. The company went on for another 18 months before entering into a Liquidation Agreement with Norwest Business Credit in May 1995 and going out of business, a sad fate for what had been a promising firm.

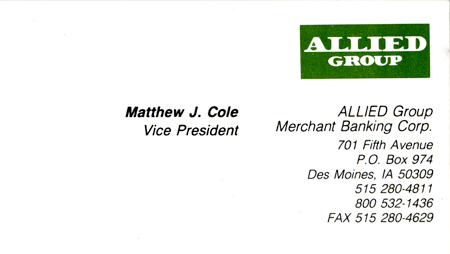

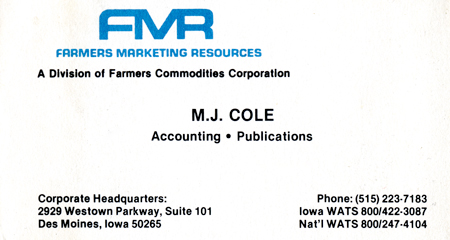

Began work with new full-service brokerage firm started by AID Insurance (later changed to ALLIED Group, as senior management was uncomfortable being AID Corporation at a time when AIDS was first being recognized, and now owned by Nationwide Insurance). Hired to do accounting and analytical work, evolved into research, writing and calculating the broker commissions, then into Corporate Finance and venture capital work. We sold some factories, divisions and companies, took a company public, helped underwrite and place a closed-end fund, arranged financings and worked with portfolio firms. This work was pretty gratifying. The venture funds were limited to Iowa investments (a way to promote growth after the farm crisis of the early 1980s) so were in a variety of industries. I spent some time trying to salvage our investment in a failing brewery, learned quite a lot about supermarkets, visited companies and researched industries. Not everything worked out, but recently when Rainbow rebuilt our local grocery store, they put in Börgen floral coolers. Börgen was one of our first investments.

The full-service brokerage firm concept eventually faded and ALLIED Group Merchant Banking continued on with the corporate finance and venture efforts. I was helping portfolio firm I.A. Bedford look for a CFO when the founder asked if I'd be interested. It was a rapidly growing profitable firm in real need of help, looked to be an exciting prospect, and I said yes.

My first proper position after college. FCC worked with farmers to hedge forward pricing risks in the futures markets, primarily through holding short positions in futures markets (to offset long position in actual crops or livestock). I worked on programs to track grain export and inventory positions, then performed analysis on the 1982 USDA Payment in Kind (PIK) program from both a price and production risk point of view. I wrote a BASIC program to take producer data in evaluating PIK bids and produce analysis of their situation; we ran these by the hundreds. I was eventually faced with choice of becoming an advisor myself or going to the position offered at ALLIED; my background is not in production agriculture, and I chose to go with ALLIED. A useful aspect of starting off in commodities was a comfort with the idea of being short in a position, and with hedging, where traditional securities markets have a long bias to them.

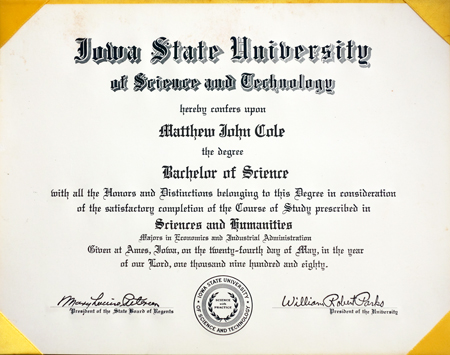

Bachelor of Science in Industrial Administration (Finance) and Economics (double major), Iowa State University, Ames, Iowa 1980. Industrial Administration would now just be called Business. The Finance was my area of concentration within the major. I also did quite a bit of accounting.

Additional coursework at Drake University in Accounting, Des Moines, Iowa 1981-83. Classes taken in preparation for sitting the Certified Public Accountant examination. The accounting I took at Iowa State (on quarters in those days) wasn't quite enough to hit the 24 semester hours needed to take the CPA exam.

University of Saint Thomas mini-MBA program, March-May 2013. I took this as a refresher once my time at COUNTRY was done. Honestly, the program is a bit thin on content given the short time frame and broad scope. It seemed a bit like a sales brochure to get you interested in doing the full MBA.

Completed Certified Public Accounting examination. I was never licensed as a CPA because Iowa required that you work for a year for a licensed CPA firm to obtain your own license. I passed the exam but never worked for a CPA firm, so don't hold myself out as a CPA.

Completed Chartered Financial Analyst examinations Levels I & II.

Held FINRA Series 7 (General Securities Representative), 63 (Uniform Securities Agent), 24 (General Securities Principal) and 27 (Financial and Operations Principal) licenses while at ALLIED. I filed FOCUS reports for the ALLIED Group Securities brokerage firm.

Microsoft Excel (including pivot tables, PowerPivot, VBA and other advanced techniques), Access, PowerPoint, Adobe Acrobat & Illustrator, SQL, Tableau 8, SpatialKey, WebFocus & FOCUS, Oracle (Hyperion) Essbase, COGNOS, html & CSS (as on this page). Additionally, I am comfortable in both Windows and OS X. I run personal copies of some of the listed software (Excel 2010, Outlook, Access and Tableau 8) on Windows 7 running under Parallels 9 in OS X 10.9.1.

Volunteer Coordinator, Nature Valley Bicycle Festival Trained, deployed and supervised scores of volunteers in setup, course marshalling and teardown for 5-day, 6-venue bicycle race series.

Certified Instructor, League of American Bicyclists . I have taught some cycling classes, more about how to ride in traffic than about how to balance and brake. I have posted the Bicycle Commuting Guide I wrote for the Commuting classes.

Supervisory Committee, Heartland Credit Union. I served on the Supervisory Committee from 2002 through 2007. The committee functioned as the internal audit area for this $91M (assets) credit union. We would actually peform the routine audit work (reviewing loan files, write-offs, vacation records, performing surprise cash counts, etc). I resigned from the Committee when Heartland closed its branch in the COUNTRY Building.

Presenter, COUNTRY Lunch and Learn Series. In a company full of insurance professionals, when it came time to do an hourlong presentation on The History of Insurance, I was chosen. It's not clear that this was an honor, but the actual presentation of The History of Insurance: Not Quite The World's Oldest Profession played to (mostly) rave reviews. I am comfortable doing public speaking and presentations and can make even unpromising topics interesting.

Backup Disaster Recovery Coordinator, Central Region. The Central Region Building had the mainframe backups for the entire company. The DR efforts developed plans to deal with IT outages, nearby train derailments, bird flu outbreaks and weather emergencies. I was third in line to close the building. As it happens, every other regional office in the COUNTRY system was closed for weather at one time or another, but the Central Region office never was.

Co-Chair, Displaced Worker Committee. In a group of 80 employees affected by this layoff wave, I was honored to be selected as co-chair of the committee to select and deal with the firm that manages the transition funds and training. In addition to dealing with Minnesota Job Partners (the firm selected), and because of my interest in photography, I offered to take LinkedIn headshots for anyone interested. About half of the displaced employees took me up on this.

Website development, online commerce and order fulfillment. I worked with a company (named Portsmith) which produced a small line of network mobile computer accessories. I wrote their website, including shopping cart and payment tools, then received and processed orders, produced invoices and customer service data, and shipped product to customers both domestically and overseas. The daily work was set up as a home business with my wife doing much of the daily shipping. During this time I also dealt with U.S. Customs on some import issues and with multiple shipping vendors, although our preferred domestic shipping was with UPS, with whom we had an account and daily pickup at the house. I even went to a couple of trade shows for Portsmith, taking vacation from MSI to do so. After around two years, the company was sold. This was active from late 1999 through late 2001.

Commissioner, football pool. This may seem like an odd thing to list, but I've run it for 18 seasons, it's in Excel, uses my own website for entry and results reporting, uses extensive VBA macros and integration with the Outlook Object Model to take in entries from about 100 participants around the country, send automated reminders, write compliant Server Side Includes (SSI) and html code, produce sparklines (years before they became available in Excel) and generate PDFs of graphs and results that efficiently report a lot of information to a diverse audience. I also write up weekly results emails that people like a lot. When I say I know Excel, VBA, Outlook, ftp, html, CSS, am a good communicator, etc., keep in mind that I do this sort of thing on my own time for fun .

There is more to life than work. I have outside interests which in many ways complement my professional work.

On the way back from a whiskey tour with some old friends, we stopped at New Madrid, epicenter and namesake of the huge earthquakes in 1811/12 and still a lurking nightmare for insurance companies. Even on vacation I'm conscious of and interested in the firm's role in the greater world. (Read the sign text here.)

On the way back from a whiskey tour with some old friends, we stopped at New Madrid, epicenter and namesake of the huge earthquakes in 1811/12 and still a lurking nightmare for insurance companies. Even on vacation I'm conscious of and interested in the firm's role in the greater world. (Read the sign text here.)

Page last updated 2/6/2014

e mail me